Pre-feasibility study into solar energy rollout in Namibia

8. Extending access – the ANE Revolving Carbon Fund

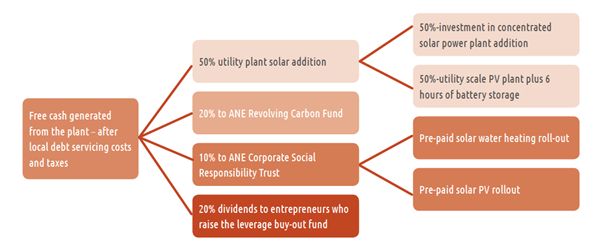

Free cash generated by the plant from year 6 will be distributed in the following way:

Distribution of free cash generated by the plant from year 6

The investment in the concentrated solar plant and the utility-scale photovoltaic plant has been discussed already. Below the micro-generation investment programme is discussed.

Reasons for a micro-generation programme

There are two key reasons for the need for a clean energy micro-generation revolving investment fund making low interest loans, accessing carbon credits and grants.

1. Affordability

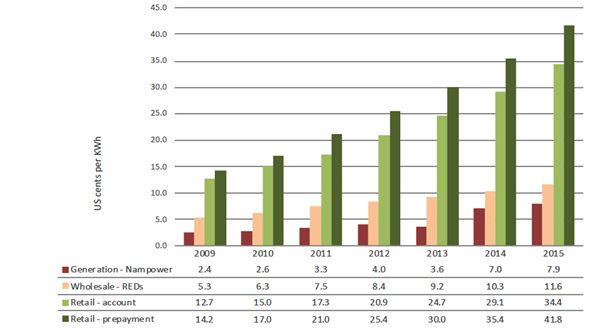

The average Namibian has a low disposable income: the recent and forecast consumer energy price increases are causing social disquiet – prepaid electricity customers are the worst off with price rises and increases are preventing increased electricity access. Namibia’s electricity prices have traditionally been some of the lowest in the world, where it has combined inexpensive hydro power with an advantageous legacy power purchase agreement from South Africa. The power cuts of 2008 in South Africa shocked the entire subcontinent into the realization that expensive new capacity was needed and South Africa has more than doubled energy prices in the last three years. In addition, South Africa’s drive towards renewables will result in a carbon tax that will increase energy costs by 30%. This energy inflation has rippled over to Namibia, and is expected to continue for the foreseeable future – with the Electricity Control Board forecasting energy inflation of at least 20% per year for the next five years.[1] This electricity inflation is already causing tensions with angry exchanges in the Karas province between councillors and RED’s, and 55% of Windhoek’s rate payers being in arrears.[2]

Generation vs wholesale vs retail pricing Namibia – 2009 – 2015

2. Off-grid access

Off-grid solar will become increasing financially viable especially as low-cost storage solutions reach the market over the next five years. Off-grid solar applications compete with higher residential rates of 15 USc per KWh vs. generation rates of 4 USc per KWh and also help the customer to avoid the large premium needed to recover grid access costs in remote areas. The state utility will welcome a large-scale roll-out of off-grid solar, as it is seldom able to recover transmission investment into low population density areas.

Sub-programmes with the micro-generation programme

Solar water heating roll-out

The benefits of solar water heaters within middle and lower-income homes in Namibia

Households are the most expensive type of customer for electricity providers to supply to as they demand electricity during the morning and evenings, when demand is at its highest. Electricity provision during peak periods can cost 10-20 times as much as baseload costs.[3] As the heating of water makes up about one-third of electricity demand of households and most water heating is done during these peak periods, solar water heating is one of the cheapest energy-saving interventions available. Secondly, solar water heating is four times as space efficient as solar PV, as up to 70% of the solar energy is converted into thermal energy, unlike solar PV panels where 17% is converted.

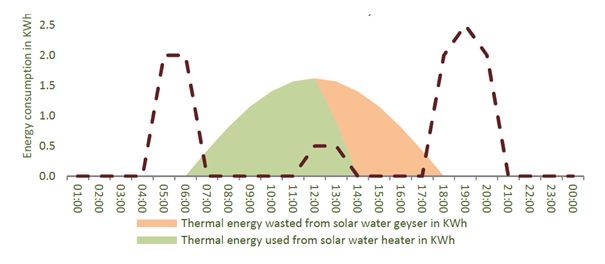

Solar water heating can cover all household heating needs – especially in winter, as Namibia is a summer rainfall region, so direct normal irradiation is relatively higher in winter. On a typical autumn day – modelled below, there is a significant amount of surplus irradiation to achieve maximum temperature.

This means that houses with smaller roofs have enough space for a solar water heater, but will usually not have the space of solar PV panels. Thirdly, solar water heating is the cheapest way of storing the sun’s energy, as water is heated up in well insulated tanks, and available for use in the expensive evening and morning peaks.

Peak time energy savings of a solar water heater on a typical autumn day. Based on 200 litre SWH and DSM electricity available but not used

It is vital that all stakeholders work towards a national solar water heating programme, where currently an estimated 80,000 households can benefit, halving their exposure to energy inflation in the next three years.

ANE’s solar water heating proposal has the following unique selling points:

- Economies of scale – ANE is not pushing any technology or manufacturer, seeking only to create a large volume competitive tender situation where the most suitable solar water heater within the Namibia context is made as affordable as is financially feasible. We target a 100 litre solar water heater to be fully installed for NA$7,000 with the potential market of 80,000 units, with scope for rolling this solution out to other countries.

- Measurement and timers – solar energy is derived during the day and stored in the form of hot water – and consumed in the early morning and evening. The timers will ensure that where there are on-grid backups, the grid is never tapped during these peak demand times. The measurement systems will also alert in the case of problems and lay the foundation for a pre-paid solar water heater.

- Carbon funded maintenance programme – as water heating consumes more energy than heating any other substance – 4.2 KJ.kg-1.k-1 – the carbon savings are substantial. As the energy saved will be measured, these carbon savings will be valuable enough to pay for the on-going maintenance and monitoring for 10 years. It is expected that each 100 litre system will save about 0.5 tonnes of carbon in Namibia, worth about NA$100 per year. This will pay for basic monitoring and the average number of call-outs over the ten year period the maintenance contract will cover.

- Innovative financing structures which enable it to access the prepaid market – the measurement and maintenance systems mean that the risk on repayment is lower than for other solar water heating proposals. This will reduce required interest rates and enable a low cost addition to a mortgage – a 4% addition to the average mortgage balance of NA$180k.

Impact of the scheme on a household’s finances – with mortgage:

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KWh saved pa | 800 | 800 | 800 | 800 | 800 | 800 | 800 | 800 | 800 | 800 | 800 |

| Elec. price – NA$.KWh-1 | 1.42 | 1.67 | 1.97 | 2.33 | 2.75 | 3.24 | 3.50 | 3.78 | 4.08 | 4.41 | 4.76 |

| Savings per year – NA$ | 1,133 | 1,337 | 1,577 | 1,861 | 2,196 | 2,592 | 2,799 | 3,023 | 3,265 | 3,526 | 3,808 |

| Repayment | (997) | (997) | (997) | (997) | (997) | (997) | (997) | (997) | (997) | (997) | (997) |

| Saving per year – NA$ | 136 | 340 | 581 | 865 | 1,200 | 1,595 | 1,802 | 2,026 | 2,268 | 2,529 | 2,811 |

The average 100 litre system target price – fully installed plus first year of maintenance and insurance is NA$7,000. Based on the interest rates that the National Housing Enterprise (NHE) is current obtaining, a bolt-on mortgage can be repaid at about NA$1,000 per year, while 800 KWh are expected to be saved each year. On a ten-year repayment, the deal is cashflow positive for the mortgage holder from day one, and by 2022 will save almost NA$3,000 per year. This will shield the mortgage payer from energy inflation on one-third of their energy consumption.

The impact on peak demand will be noticeable. Assuming the average electric element uses 1.5KWh in peak times, the total impact of the 11,200 houses currently on the portfolio will be to reduce peak evening and morning consumption by 17 MW out of the total, and the total carbon saving per year will be about 5,000 tonnes. The revenue derived from this carbon sale could be used to help fund a 10 year maintenance contract.

1. Pilot

ANE will carry out a pilot on 50 houses in the NHE Portfolio. The pilot will test the effectiveness of the scheme as well as covering the consulting costs of registering the scheme for carbon purposes.

2. Retrospective fit to all houses on the NHE portfolio

The NHE provides an important volume driver for a large-scale roll-out of solar water heaters and the finance via its access to low-cost funds, so at this stage will not require capital from ANE, apart from the pilot costs and management time.

ANE has already received a letter of support from the NHE, saying that on completion of the pilot, they will retrofit the 11,200 houses on their portfolio and will do so over a five year roll-out, completed by the time the carbon fund is launched.

3. Roll-out to other creditworthy customers

Other low-credit risk customers in Namibia include:

- houses that have mortgages with high street banks

- the hospitality industry

- social infrastructure and government buildings, of which all new builds are required by law to use solar water heating

ANE will use its revolving carbon fund to finance these at low interest rates – 6%. It is estimated that about 8% of households and most commercial enterprises will fall into this category, so the demand will be about 20,000, 200-litre-units, rolled-out over 3 years from year six of the project. Total loans underwritten will be NA$200 million or US$20 million. The carbon fund in its first three years will have sufficient funds to underwrite this with commercial banks or extend loans itself. It is expected that bad debt ratios will be lower than 10% and that 50% of the carbon fund’s micro-generation budget will be used towards this sector of the solar water heater market in year six – continuing to year eight.

Roll-out of energy saving devices and solar water heaters to pre-paid electricity customers

Most households in Namibia pay for electricity via mobile pre-payment systems, rather than on account. Without accurate figures, the author estimates that 50,000 of the 80,000 household electricity users use prepayment. To extend access to this market, solar water heater financing will not be viable. Experience in South Africa suggests that there is not a sufficient credit culture to bank on repayment, and unlike certain consumer goods such as cars, TVs and furniture, it is not practical for a solar water heater to be repossessed on non-payment.[4]

This sector of the population is most vulnerable to electricity inflation, so this market is ignored at the country’s peril. However, servicing it will require the 4 C’s:

- Concessionary finance, which ANE will be able to provide in the form of the Corporate Social Responsibility Trust, which will receive 25% of the free cash allocated to the Carbon Fund

- Carbon credits to finance maintenance and monitoring programmes for the solar water heaters and 100% financing for insulation and low-energy lighting

- Community peer-pressure credit management techniques as pioneered by the Grameen Bank, where communities will be given credit targets, which if they fail to achieve, will result in no new installations, until repayment levels resume

- Change in the technology, to enable customers to buy a pre-paid hot water service in the same way they buy electricity, using mobile micro-payment systems over their mobile phone. The technology is available and a suitable partner found. The solar water heaters will need to be modified to cater for cut-off after pre-paid solar water heating has been dispensed. The electronics will have to be made tamper-proof – and customers will have a financial incentive to use the solar water heater to heat their water rather than pre-paid electricity, as the pre-paid cost of solar water heating will be 50% of the cost of using pre-paid electricity to heat the water, with regular use resulting in ownership after 5 years

Even with these interventions, it is expected that bad debts on the pre-paid solar water heating and solar PV will be at least 50% – they would be close to 100% without them so only concessionary funds are suitable. The social benefits are worth it. ANE estimates that the market will have grown to 70,000 by the time the scheme is launched, and that it will take five years to implement.

Energy savings from the solar water heater (100 litre) are estimated at 500 KWh per year from the solar water heating, while the carbon funded insulation and the LED lighting will add another 300 KWh per household, so the savings to the grid are a significant at 560 GWh or 8% of the 6.5TWh forecast demand in 2022. The costs of $14 million per year will be funded by the Corporate Social Responsibility Trust from year 7, with pre-payment proceeds re-invested in other social projects within the community whose residents pay for the pre-paid solar water heating.

The total potential for solar to provide the energy to heat water in Namibia can save the country up to 10% of current demand – most of it at the most expensive peak demand times. It is the cheapest, most space efficient form of solar energy provision and has storage built in. It has a role to play in Namibia’s goal of achieving carbon neutral energy security in an affordable way.

Adding Solar PV with battery storage

ANE will to use the revolving carbon fund to offer low-cost loans to farmers, tourist facilities, social service providers and credit-worthy residential customers the ability to buy solar PV and battery storage. This will form a key part of the solar PV roll-out.

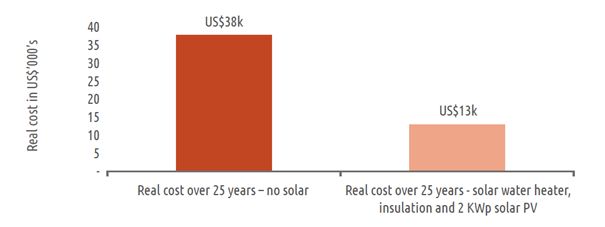

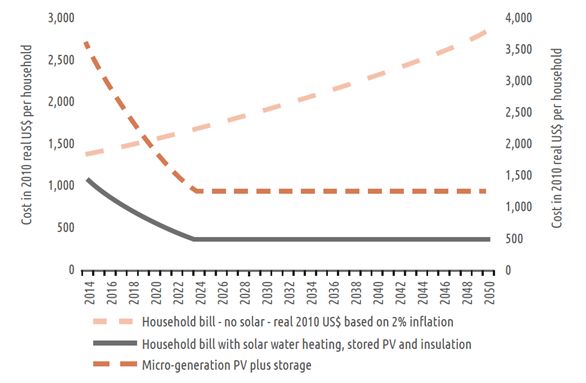

The economic attractiveness is simple enough. A three-way package that includes, Solar PV, solar water heating and better insulation will be two-thirds cheaper even with the most optimistic grid inflation forecast (2% real increase per year).

Savings over the life of a combined solar water heating, solar PV and insulation upgrade on a top 20% consumption house in Namibia

Key assumptions – apart from real inflation include:

- 300 KWh demand per month – 20th percentile demand in Namibia

- 2KWh PV system with 12.5 KWh of battery, replaceable every five years

- House has suitable roof space – where 13 m2

- Finance is in the form of a 10-year loan for NA $8,200 in 2014 at 6% interest rate – equivalent to the local currency government borrowing rate – resulting in repayment of about US$1,200 per month in 2014, the planned start date and after ten years; this debt will be paid off.

- The solar panels will be guaranteed to perform for 25 years.

- Maintenance, insurance and remote monitoring will be paid for carbon credits on voluntary carbon markets at $10 per tonne

- Solar production of 1,500 KWh per KWp based on global horizontal irradiation of 5.5 KWh per square meter per day.

Decrease in costs per KWh of solar PV vs. forecast capital costs

The graph above shows the increasing attractiveness of solar and the key reason for delaying this roll-out. By 2020, solar will deliver electricity at half the current residential rate in Namibia.

Cost of systems are decreasing by 8% per year and will eventually flatten out at $1.00 per watt (2010 US$) in about 15 years’ time. The fact that a loan depreciates by 6% per year in real terms from the effects of inflation and the author has assumed that the on-grid retail electricity price will only increase by 2% in real dollar terms from 2014 – currently it is increasing by 18%.

[1] Helena Vosloo, Head of Economics – Electricity Control Board in meeting with ANE on 15 June 2011 at ECB offices in Windhoek

[2] Harald Schütt – independent consultant and former director of the Renewable Energy & Energy Efficiency Institute – in conversation with the author in meeting on Wednesday, 5 October 2011. Both incidents were reported in the daily news.

[3] Harald Schütt – independent consultant and former director of the Renewable Energy & Energy Efficiency Institute – presentation

[4] Inconversation with Mercantile Bank in South Africa, this worked with Teljoy on a failed solar water heater roll-out programme. Teljoy is best known as a television rental company in South Africa.

0 Comments