Pre-feasibility study into solar energy rollout in Namibia

2. Electricity supply in Namibia

NamPower’s existing generation capacity and future plans

Background and financial position

NamPower is a state-owned utility that owns and operates generation and transmission capacity that it inherited at Independence in 1991. The company also owns shares in regional electricity distributors, and regards the management of transmission and integration into the Southern African Power Pool, the regional power grid, as key competencies. As it did not pay for the infrastructure it inherited from Eskom in 1991, it is profitable and has large and accumulating cash reserves – after tax profits were NA$273 million (US$34 million) on a turnover of NA$1 804 million (US$225 million) – an after tax profit margin of over 15%. With its short-term cash deposits of NA$2,885 million (US$360 million – equivalent to 19 months of 2010 revenue), and debt of NA$1,200 million (US$150 million), NamPower has a strong balance that generated healthy net finance income in 2010 – NA$148 million (US$19 million).

Generation

NamPower reports 993 MW of capacity of which one-third is located within Namibia, there is no independent power production of more than 0.25MW, so it is ignored.

| Plant/source | Energy source | Installed capacity in MW | Generation – 2010 GWh | Load factor |

|---|---|---|---|---|

| Ruacana | Hydro | 249 | 1,257 | 58% |

| Van Eck | Coal | 120 | 46 | 4% |

| Walvis Bay (Paratus) | Diesel | 24 | 3 | 4% |

| Interconnector | Mainly coal – imports from SA and Zimbabwe | 600 | 2,462 | 47% |

| Total | 993 | 3,767 | 43% |

The majority of Namibia’s local electricity generation is from hydroelectric power on the Kunene River at the Ruacana Plant, which is has three 82 MW turbines, with a fourth being available in 2012. Van Eck is a small coal-fired power station near Windhoek that tends to be used for hours at a time during winter peaks, while Paratus near Walvis Bay and the soon to be built Anixas are diesel peaking plants, with extremely high levelised electricity costs due to high diesel feedstock costs as well as low capacity utilisation.

The Ruacana hydro-lectric scheme on the Kunene River in Northern Namibia, supplied 96% of Namibia’s locally generated electricity in 2010. It is being expanded by 92MW or one third.

Local generation expansion projects

With the Hwange contract expiring in 2013, NamPower is considering a number of expansion plans into baseload and mid-merit: Some have been considered for decades – such as Kudu, while others – such as renewables have only recently been mooted. Due to the imminent shortages, plans are in a state of flux. A summary of the key base load projects listed by the NamPower financial statements are listed below:

Kudu Natural Gas project – Kudu has been proven since 1974, but remains technically daunting:

The capital expenditure will cost $1.2 billion and the natural gas will be processed offshore, which gives NamPower little pricing power for feedstock. Other challenges include:

- Over-capacity for current Namibian needs – an 800 MW plant has been proposed, where Namibia will use less than half on current usage trends. It is therefore dependent on Eskom for an off-take agreement, which it has failed to negotiate since 2005. Due to the imminent shortage, NamPower has desperately been negotiating with the international consortium (comprising Tullow Oil and Gazprom) for an off-take agreement.

- Foreign currency exposure – a key sticking point on negotiations has been denomination of feedstock contracts. NamPower is reluctant to be exposed to the US$, while the development partners require repatriation of the $1.2 billion of foreign capital.

- Development risk – only in the last ten years was the extraction of this gas technically feasible. It remains a daunting technical challenge extracting the gas 170 kilometres off the coast. The proposed subsea tie back which would potentially make it one of the world’s longest, while the Kudu-8 exploration well was abandoned in 2007.

Walvis Bay Coal Power Station – a 250 MW – 500 MW power station has been proposed, but has fallen foul of environmental concerns, after NamPower failed to get its original site approved. The power station will take at least five years to plan and build, and the capital budget of $1.2 million per MW seems optimistic – this is half the cost of building in the US and ¼ of the cost per MW of South Africa’s much larger projects. NamPower admits that it will be impossible to have this project ready before 2016. It is also exposed to foreign currency fluctuations as the coal needs to be imported. The expected coal price is US$80 per tonne less than half of the cost NamPower is paying for van Eck’s coal.

Hydroelectric projects – these include the Baynes Hydro Power Plant (500 MW) on the Kunene River and LOHEPS – a proposed hydroelectricity scheme on the Orange River. Both have been considered for several years and face political challenges. In the view of the author, both are viable projects that will help deal with Namibia’s power shortages in the future at the lowest absorbed electricity cost – when compared to all alternatives. It is unlikely these plants will be commissioned before 2018 according to NamPower.

Other Utility scale renewables projects in Namibia

The study draws on a paper by Dr Detlof von Oertzen, who has advised the author on many issues relating the Namibian grid. In theory Namibia should be an ideal location for renewables:

Solar irradiation – It is the highest solar irradiation in the world – with solar panels able to generate up to 2,000 KWh per kilowatt capacity (the UK generates 800). The largest project so far is the 200KW Tsumkwe Solar hybrid mini-grid system installed by Juwi on EU grant funding in the north of the country. NamPower partnered with the European Commission, Desert Research, Foundation of Namibia and Otjozondjupa Regional Council to implement the Tsumkwe Solar hybrid mini-grid system.

Low population density – Namibia has the second lowest population density in the world, so centralised electricity transmission systems are not financially viable in rural areas. This boosts the need for off-grid community and micro-generation systems.

Wind and wave power – It has over 1,000 kilometres of coastline which gives excellent potential to harness coastal winds. The Luderitz Wind Farm has fallen foul of NamPower on technical grounds and the Japanese funders have pulled out of the transaction. Vestas are in discussion with NamPower to use the wind project to cover 25% of the 2013 shortfall. Wave power is still in its infancy.

Geothermal – the author has come across much anecdotal evidence of warm springs and thermal seepages. The tectonic plate movements explained by experts suggests that there are a number of rift formations that will give rise to close-to-surface level geothermal resources. Unfortunately, these have never been surveyed. It is ANE’s intention to use some of the corporate social responsibility funding to commission academic studies into using geothermal as a means of boosting tourism and local energy generation in several parts of Namibia.

Biomass – perhaps the most advanced, where NamPower has signed a power purchase agreement for a 250 KW generation system – C-BEND. In the view of the author, biomass has a limited role to play, due to the fact that 99% of the country is not arable. That said, there are areas in the North of the country, which have uncontrolled and damaging bio-mass growth, that could be processed in a sustainable way. Both the local consultants that ANE engaged believe in the potential for biomass to play an important role in solving the country’s electricity crisis.

Waste heat – a project involving turning the methane from the waste dump in Windhoek into heat to replace the electricity a local brewery uses, is potentially an excellent small-scale project that could be repeatable. Based on an estimate by the African Development Bank, Cape Town produces about 0.7 tonnes of waste per person per year that could be turned into 500 KWh. This in theory could potentially replace 25% of Namibia’s existing supply. If heat is generated and it is used directly to replace heat, 250% of the electricity originally used for the heating process can be saved. The combination of carbon credits (each tonne of methane saved is equivalent to 21 tonnes of CO2, generating a US$300 per tonne, five times the price of electricity).

Government policy on renewables

The government policy around renewables needs input – something the government openly acknowledges.[1]

Areas that need addressing include:

- There is no national renewables target

- There is no renewable energy legislation

- Independent Power Producer’s allowance return on capital is below the required returns of investors

- There is no feed-in-tariff for micro-generation, where renewables are cheaper than fossil fuelled grid connection costs

- Where net metering is available, it pays 40% less than the retail electricity price

- Financing of micro-generation is limited and only available to credit-worthy customers – less than 10% of the population

- There are no accelerated tax allowances outside the farming sector – in South Africa renewables can be written off over three years. Strangely, mining equipment can be written off over three years, so there is potential for mines to exploit renewables.

Electricity imports

Overview of the Southern African Power Pool

The 15 member Southern African Power Pool (SAPP) was created with the primary aim to provide reliable and economical electricity supply to the consumers of each of the SAPP members, consistent with the reasonable utilisation of natural resources and the effect on the environment. Dominated by Eskom, which produces 50% of sub-Saharan Africa’s electricity, the Power Pool can claim to be successful. Perhaps the best examples of co-operation are the 1.3GW Mozal Smelter deal between South Africa and Mozambique and the Hwange deal (see below).

South Africa

A discussion on South Africa’s electricity situation is a paper in its own right. As NamPower’s 2014 projection involves Eskom supplying more electricity than NamPower itself, it is important to understand the South African power situation.

Zimbabwe

Recent events suggest that NamPower has shown world-class skill in diversifying its reliance from Eskom. The award-winning Hwange deal with ZESA (Zimbabwe Electricity Supply Authority) enabled Namibia to reduce its reliance on Eskom imports 40%. Zimbabwe’s economic implosion meant that it was unable to raise US$40 million urgently needed for maintenance on its Hwange Power Station. Namibia raised the capital in the form of a loan to ZESA, which repaid in kind in the form of 150 MW of capacity with no variable cost per kilowatt hour, at capacity provision price of $5.14 per kw per month.

Amortising the loan against cost of sales, where 891 GWh were sold for a loan repayment of US$8.8 million means that NamPower was able to replace of 40% of its imports at an effective cost of 0.9 US cent per KWh.[2] The 150 MW delivered 891 GWh, which assuming transmission losses of 6% means that Hwange has been operating at a load factor of 73% – effectively full technical capacity. The deal started in 2008 and Zimbabwe, which is facing acute electricity shortages as its economy recovers, has indicated that this contract will not be renewed.[3]

ZESA estimates that the country requires 2,000 MW of power a day but the country currently produces only 1,300 MW and imports 300 MW, leaving a shortfall of 400 MW.[4] Recent indications are that NamPower has offered 36% more to keep ZESA in the deal until its expiry in 2013.[5]

Other potential import sources

NamPower hopes to increase imports from Zambia and to participate in the Southern African Power Pool. ANE estimates that they can potentially source 400 GWh by 2014, as all countries face immediate capacity constraints. The Power Pool has great long-term potential – particularly on hydro-power from the proposed Inga project in the DRC, but these projects take over a decade to plan and build, so will not cover the country in its 2013 supply shortfall.

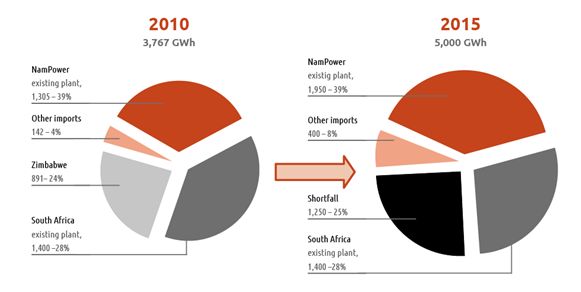

Key assumptions are:

- The Anixas Diesel Generator Power Station will be commissioned in 2011 and will operate the same load factor as the Paratus Power Station. This gives 5% of Namibia’s peaking power.

- Van Eck Coal Fired Power Station generates 200 MWh per year – about a 15% load factor.

- Eskom supplies at the same level as 2008 – 1,400 GWh, an optimistic assumption considering the Integrated Resource Plan of South Africa assumes a shortfall of 8,000 GWh between 2012 and 2016.

- The Hwange deal ends in 2013 and Zimbabwe uses the 150MW currently being dispatched to Namibia to replace its own 400MW shortage.

- The Caprivi Interconnector will enable Namibia to import 400 GWh on a 5MW capacity. The 951km 350KV HVDC lines and converter stations linking the far north-east with central Namibia was commissioned in 2010.

Time of Use[6]

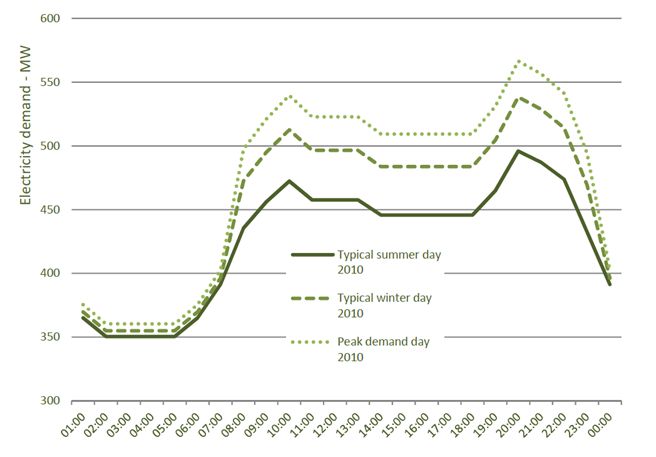

Electricity pricing varies greatly depending on when it is used, with residential customers causing morning and evening peaks. Namibia’s residential market does not have access to natural gas, so uses electricity for heating of water and environment, greatly increasing winter demand. Indeed, the peak winter demand of 568 MW in 2010 was 20% higher than that of a typical summer’s day.

Time of Use model

Figure 14 – Namibian Electricity Demand – Daily Time of Use

Important for electricity cost analysis is what is called “8760 Analysis”, where the hourly demand for each hour in the year is sorted from highest to lowest. The name 8760 is derived from the fact that there are 8,760 hours in a year based on 24 hours per day 365 days per year. The hour of peak demand is likely to be in a cold winter evening, when baths are running, food is being cooked and heating is on in houses. The time of lowest demand is Christmas Day, when mining activity has largely stopped, no commercial businesses are open and there is no need for heating.

As Namibia gets wealthier, this profile will change – in hot, high-income regions such as Spain and Atlanta, the peak demand is driven by air-conditioning to keep homes and buildings cool in the middle of hot, summer days. It is no accident that Solar PV has been adopted in these countries.

Winter peak demand is particularly expensive, as capacity needs to be available for the whole year, but can be used as few as a few hours per year as is the case with the Paratus power station, which is in full use equivalent – effectively less than 80 hours per year.

The reason for this is that the much of electricity costs are fixed overheads.

[1] Meeting between ANE and the ECB on 16 June 2011, where ECB asked ANE to add policy suggestions to improve the investment climate for renewables

[2] NamPower Annual Financial Statements 30 June 2010 – Note 9 Loans and Other Receivables page 94

[3] Confirmed publically by the CEO of NamPower, Mr P.I. Shilamba in a presentation on the future of the wind sector on 7 November 2011

[4] Source Afrique Avenir Zimbabwe, Namibia reviewing electricity barter deal 11 February 2011 http://www.afriqueavenir.org/en/2011/02/09/zimbabwe-namibia-reviewing-electricity-barter-deal/

[5] Jo-Mare Duddy –Zim puts spark in power tariffspublished in The Namibian – 16 November 2011 http://www.namibian.com.na/news/full-story/archive/2011/november/article/zim-puts-spark-in-power-tariffs/

[6] The Namibian Time of Use Model is not based on actual numbers, which are not publically available, but an extrapolation based on other countries’ seasonal patterns. The model is explained in detail in Addendum B

0 Comments