Pre-feasibility study into solar energy rollout in Namibia

4. Constraints faced by a utility-scale independent power producer in Namibia

NamPower indicated to the author that they welcomed independent power producers (APPs), especially in the area of renewables, but did indicate that any power purchase agreement was to be signed with them, rather than directly with a RED or large mine. Any SAPP trading would also involve NamPower, as all transmission lines connecting to neighbouring countries are owned by the utility.

NamPower’s solid financial position and track record of conservative, technical competence will have an important bearing on the solution ANE proposes:

- State-owned utilities are conservative by nature – they are only noticed when things go wrong, so tend to be careful. In NamPower’s case, the legacy of a profitable, cash-rich business means that management have a number of alternatives and are not desperate.

- Its strong balance sheet means that it is able to finance – at a lower cost of capital than independent power producers – generation infrastructure.

- NamPower is extremely concerned about independent power producers’ intermittent renewable energy supply disrupting the grid, so will demand storage and intermittency management.

- Its skill at trading on the Southern African Power Pool, gives it confidence to seek to repeat the Hwange deal – especially with the transmission investment connecting Namibia to Zambia via the Caprivi Strip, meaning that a local power producer will need to offer better value, predictable supply and speed of deployment to beat the alternatives.

Pricing and financial constraints

Pricing constraints likely to be imposed by NamPower

NamPower will not pay an independent producer more than it is currently paying for its highest price imports. Its local production from fossil fuels is also inexpensive, while the costs of its hydro-electric power are marginal, as there are no ownership costs to recover. ANE estimates from the pricing analysis above that price maximum NamPower can afford is 7.5 US cents per KWh in 2014, the same price that they are estimated to pay for Kudu.

Returns on capital constraints set by the ECB

The ECB made it clear as did the Department of Mineral and Energy Affairs that they were concerned about energy security and strongly welcomed the investment that ANE proposes. From the two meetings with the board of the ECB it seemed that applying for a provision generation license would be straight-forward and the costs of the application immaterial – US$100. However, their rule that capital recovery should enable a maximum return of 11% is higher than NamPower’s which is backed by a sovereign guarantee, but lower than that of an independent power producer. The rate of return in local currency is estimated at over 25%. ANE uses a subsidy system to subsidise solar to overcome this problem.

Foreign exchange risks

Foreign exchange risks have made the Kudu Gas deal impossible for international capital providers to back. The Namibian Dollar is linked to the South African Rand, so a forward market will be able to be accessed. Discussions with local banks suggest that they will only offer forward cover for five years, which is not enough time to recover debt or equity in most cases.

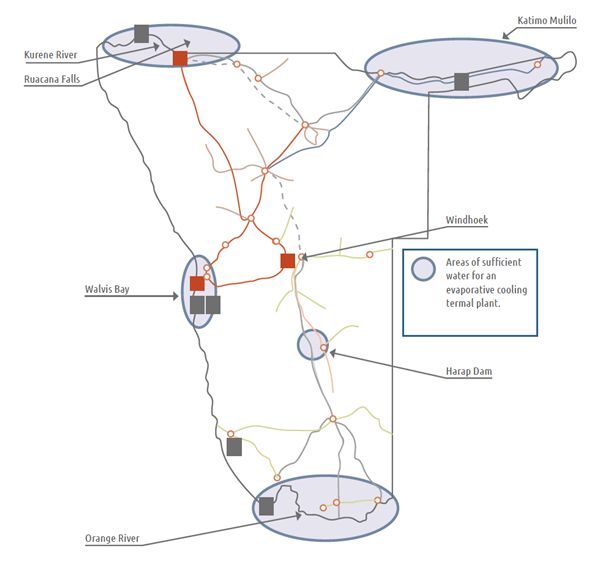

- Kunene River in the far North

- Orange River in the far South

- Hardap Dam near Mariental

Transmission and water constraints

Figure 24 – Transmission infrastructure

Namibia is mainly desert, where water is scarce. Certain technologies use water – for instance Concentrated Solar Power Parabolic Trough systems uses 3.6 litres per kilowatt hour – three times that of coal. A 300 MW plant will use 6,000 cubic meters of water per day – the same as a medium-sized mining operation. This restricts the location of a CSP plant to the Kunene River, Orange River and Hardap Dam. Sea water cooling could be a possible solution, while evaporative cooling systems reduce performance by up to 20%.

0 Comments