Pre-feasibility study into solar energy rollout in Namibia

6. ANE’s Gas to Solar Solution – overview

Namibia’s power sector is similar to the rest of Africa in that it faces three key problems:

- electricity shortages – 40% of peak demand in 2013

- limited population access – just one third of the population has access to electricity against a sub-Saharan African average of 26%, and

- affordability – three years of 20%+ increases in electricity prices has resulted in over half of the certain municipalities being in arrears with electricity payments.

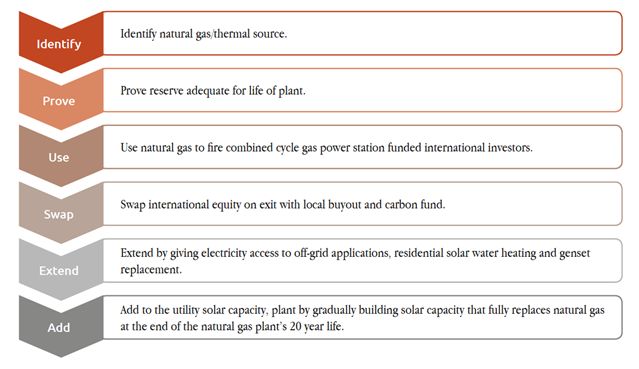

The ANE development strategy was applied to Namibia to produce in a carbon-light, cost effective solution, using stranded natural gas,[1] and replacing it with solar over time by:

- Identifying potential stranded natural gas sites – 6 were found with potentially sufficient reserves for a 300 MW plant, close enough to transmission lines.

- Proving the reserve using emerging technologies such as proven “Surface Exploration”[2] technologies e.g., “Airborne Transient Pulse A-EM Surveys” “Passive Ground Tellurics,” “Windowed Radiometric Surveys” and geochemical sampling as well as low-cost exploration well drilling techniques.

- Using the natural gas in a combined cycle gas plant, which will produce over 50% of Namibia’s needs in 2013, replacing 80% of high risk regional electricity imports.

- Swapping foreign ownership, by enabling a consortium of local owners to give international investors a year five exit, with a low-risk leveraged buy-out fund.

- Extending access to electricity using solar micro-generation – starting with a Universal Basic Electricity Access Programme (U-BEAP), giving the two thirds of the population with no access to electricity access to LED lighting, ability to charge a mobile phone and listen to a radio, followed by a national solar water heater rollout, insulation and energy saving programme and finally solar PV residential roofs.

- Adding to plant capacity with concentrated solar (integrated solar thermal) and utility-scale photovoltaics with battery storage to supply peak periods.

With a foreign investment of just 4% of GDP, this strategy will achieve the following:

- Grid-wide generation cost reduction of 20% in the first year of plant operation.

- 100% of the population getting basic access to electricity within two years.

- Immediate savings of 500,000 tonnes of carbon emissions per year with each $1 of foreign investment will result in carbon re-investment of $5.50 – delivering in 100% electricity access within 25 years, where 70% of households derive more than 50% of their energy needs from solar.

ANE’s development strategy is replicable throughout Africa, which has a surplus of flared and other known, undeveloped, on-shore stranded natural gas deposits. For instance, converting 50% of Angolan and Nigerian flared natural gas will increase electricity production by 350% increasing GDP by 30% in each country.

The Stranded Gas to Solar Concept

Stranded natural gas is defined as natural gas that has no access to a market, and therefore no resale value. This is a common phenomenon as natural gas infrastructure required for processing is extensive. A gas-to-liquid processing plant (GTL) costs $2.5 billion and it is generally accepted that a GTL plant will need at least 1 trillion cubic feet (180 million barrels oil equivalent) to recover the investment.

Natural gas also needs access to a pipeline network, which Africa does not have. Gas pipelines cost $0.75 to $2 million per kilometre, and can face years of planning delays and even geo-political intrigue. Extracting oil has much lower barriers to entry and is more lucrative, so more energy companies focus on oil and leaving many natural gas deposits in situ, known and undeveloped.

Converting natural gas into electricity makes sense on a continent with chronic shortages of electricity and little natural gas infrastructure. The table below compares natural gas to coal and nuclear as a feedstock:

| Technology | Nuclear | Coal | Combined cycle natural gas |

|---|---|---|---|

| Build time in years | 10 | 8 | 2 |

| CapEx – US$ per watt | $7.50 | $1.2 -$5.00 | $0.60-$1.20 |

| Life in years | 40 | >40 | 20 |

| Levelised electricity cost – US cents per KWh | 20-30 cents | 7-15 cents | 7-10 cents |

| Thermal efficiency | 38% | 37% | 60% |

| Carbon emissions – tonnes per MWh | 0 | 0.7-1.40 | 0.3 |

| Externalities | Safety perception, government guarantees needed, spent fuel | Water, pollution, long term scarring of countryside | Water |

The ANE development process

ANE investigated several clean energy alternatives and found that the cheapest and most technically feasible solution lays in accessing stranded natural gas and turning it into cheap electricity and gradually investing plant profits into utility-scale solar and microgeneration. ANE’s development process works as follows:

ANE Development Process

Identifying potential natural gas resources

There is currently no natural gas production in Namibia, so no prospect of using flared natural gas – see more detailed discussion in Addendum A about flared natural gas. But it has a large proven reserve.

The Kudu gas field is an offshore field approximately 170 kilometres (115 miles) north-west from the city of Oranjemund. It is located in the Orange Sub-basin in 170 metres (557ft.) of water. Discovered in 1974, the license has been held by a number of companies including Royal Dutch Shell, Chevron Texaco and Energy Africa and lately Tullow Oil and Gazprom. The field is estimated to contain 1.3 trillion cubic feet.

The Namibian government remains committed to developing Kudu, and building an 800 MW natural gas power station but the challenges the owners face are significant:

- Feedstock pricing – there is no known oil in Kudu, so it will only be viable if the natural gas is processed. As processed natural gas is worth more on the international markets than NamPower can afford to pay, the partners will be reluctant to sell the gas to NamPower. The 800MW power station will use an estimated 120 Mmscf per day – over the twenty-year life – about 900 bscf – some 70% of proven reserves, crowding out more lucrative revenue opportunities.

- Development risk – to transport the natural gas, a 170 km undersea cable will need to be built, breaking the world record for the longest undersea natural gas cable.

- Foreign exchange risk – the international developers of Kudu will require payment in US$ to recover the estimated $1.2 billion capex from NamPower, while NamPower receives income in NA$. This exposure to the volatile rand requires a hedge to be in place – and it is difficult to see how one can be created. Power purchase agreement sharing – Namibia’s planned 800 MW power station requires co-operation from Eskom to offtake 300 MW for a five to ten year period. Since attempts in 2005, no agreement has been reached with Eskom.

In short, Kudu is not stranded gas – and is technically challenging to develop so it is not an ideal solution. Namibia has many instances of natural gas seepage and evidence of on-shore oil. There is much local knowledge that can be harnessed, and cross referenced with traditional top level geological evaluation techniques. Using techniques described in addendum A, ANE has used non-mainstream techniques to find other potential sources of natural gas.

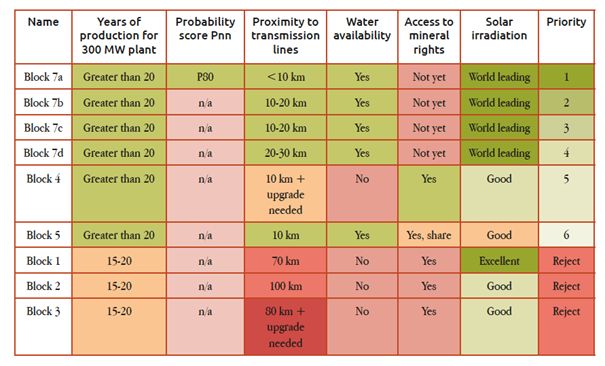

Natural gas leads identified by ANE and its exploration partners

Proving reserves

Hydrocarbon companies find exploration risky and difficult. It is estimated that discovery costs are $12 per barrel. The decade from 2000 has shown that companies that embrace new technologies have built significant competitive advantage – for instance Tullow Oil has an 85% success rate in drilling – while BP’s is only 50%. HRT – a major player in Namibia – has a market capitalisation of $4 billion without any production, due to the respect the management team accords for its holistic technology approach to prospecting.

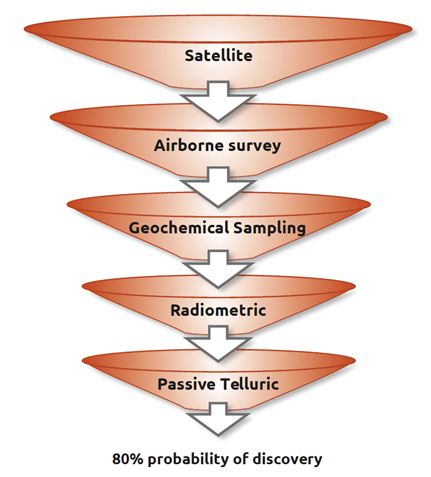

ANE’s adopted stranded gas discovery process

ANE and its exploration partners based their exploration philosophy on the old Chinese proverb – “When you want to know the truth – ask the same question of many people”. There are many independent technology methods that can be used to find hydrocarbons, that use physical evidence of seepages, satellite data, geological, geophysical, geochemical and hydrocarbon microseepage–based Surface Exploration technologies, which is not suitable for finding the smaller, more subtle formations that ANE is looking for.

Seismic is not suitable for this environment as it:

- struggles to differentiate between brine (salty water) and hydrocarbons

- has difficulty in penetrating volcanic basalts above the hydrocarbon sediments, which are common in Namibia

- is more effective in finding the structural traps that are likely to contain hydrocarbons, and struggles to isolate more subtle fluvial-dominated deltaic stratigraphic traps, that ANE and its partners have identified in Namibia

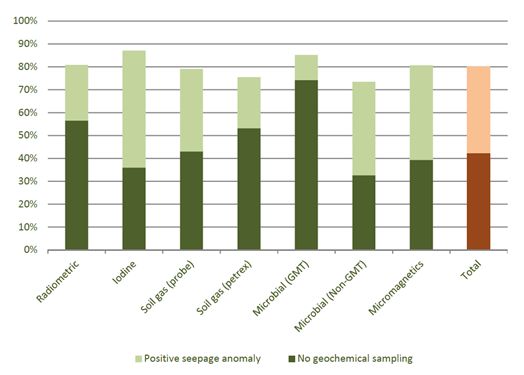

The manner in which ANE has been able to identify so many sites with so few resources, is proprietary information. But once it has identified a lead – as it has done as per Figure 38 – natural gas leads identified by ANE and its exploration partners, it proposes to prove the reserve, using the following techniques, which are cheaper and simpler than seismic. Exhaustive peer reviewed academic studies have proven these techniques to achieve 80% success rates when used in concert with each other.[3] The paper sited, collected data on over 2,700 wells across the world from every type of hydrocarbon setting.

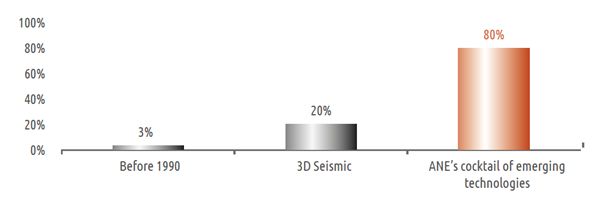

Discovery rates are improving, as the industry embraces new technology. See below:

Success rate when drilling wildcat exploratory wells

Effect of geochemical sampling on discovery rate of hydrocarbons,

when used in conjunction with other technologies

[1] Stranded Natural gas is defined as natural gas that has no access to a market – it could be undeveloped – i.e. left in the ground or if a by-product of oil production, flared or re-pumped in the well to increase well pressure.

[2] As defined specifically in the Introduction to Surface Exploration Case Histories: Applications of Geochemistry, Magnetics, and Remote Sensing, published jointly by American Association of Petroleum Geologists and Society of Exploration Geophysicists, 2002.

[3] Schumacher, D, 2010, Integrating hydrocarbon microseepage data with seismic data doubles exploration success, PROCEEDINGS, INDONESIAN PETROLEUM ASSOCIATION Thirty Fourth Annual Conference and Exhibition, May 2010.

0 Comments