Pre-feasibility study into solar energy rollout in Namibia

7. Using the gas – the combined cycle plant

Engineering overview

Natural gas processing plant

The natural gas extracted from production wells needs processing before it is “pipeline specification” – i.e. ready for use in the power plant, after the removal of unwanted by-products such as:

- Sulphur

- CO2

- Water vapour

- Nitrogen

- Trace elements such as lead, zinc and copper, which have high concentrations in one of the local areas.

The process of extracting natural gas is illustrated below:

![Typical natural gas processing plant[1]](https://www.ane.na/wp-content/uploads/2018/08/Clipboard09.jpg)

Typical natural gas processing plant[1]

The engineering “rule of thumb” is that a natural gas processing plant costs approximately US$1 million per million standard cubic feet per day (Mmscfd) processing capacity – and US$1.5 million per Mmscfd for full conversion to Liquid Natural Gas.[2] As this plant will need about 45 Mmscfd, the input feedstock to the processing plant, plus contingency should be specified to 60 Mmscfd, so capital expenditure has been estimated at $100 million for the non-GTL plant alone – excluding pipelines, storage and loading facilities.

300 MW Natural gas combined cycle plant.

A 300 MW combined cycle plant will produce 2.2 TWh at an 85% capacity, enough to cater for 50% of Namibia’s current electricity needs. It will replace 80% of imports including the Zimbabwean deal, which supplies 40% of imports. The plant will require 50 MMscfd of natural – a 20 year reserve of 0.35 trillion scf – too small to justify a traditional investment in pipelines or a gas-to-liquids plant. The plant will take two years to build, with capex estimated at 4% of GDP, comprising wells, pipelines, natural gas processing, generation and grid integration.

Substantial geological work has been done to confirm the presence of hydrocarbons. Currently ANE targets a price lower than the forecast Eskom supply price in 2015 and the replacement of imported or interim supplies will reduce NamPower’s generation and cost of electricity by 20%. The plant will also generate 600,000 tonnes of saleable carbon credits, which will contribute to foreign exchange. As the natural gas source will be owned by the buyer, input cost is expected to be at marginal cost – or a significant discount to the US & UK prices respectively.

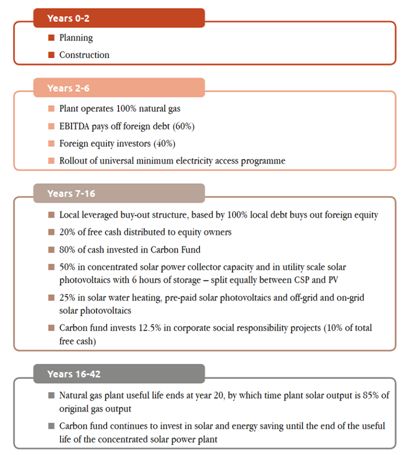

Integrating concentrated solar power

Solar replacement – After year 6, when the international capital providers have exited their investment, the carbon fund will invest 25% of its annual cashflows into concentrated solar power and 25% into solar photovoltaics – both with 6 hours of storage. This stored electricity will be supplied to the grid and by the time the natural gas combined cycle plant comes to the end of its 20-year life, these will continue for another 20 years.

e-Solar’s revolutionary new modularised concentrated solar plants

The engineering solution takes advantage of the fact that the most expensive components of a concentrated solar power plant are the collector fields (mirrors that reflect light onto an absorbed tube or power tower) – 60% of total costs, and the storage systems at 25% of total costs. As on a traditional concentrated solar power plant, the thermal efficiency is just 30%, a natural gas input increases the solar efficiency to over 60%, meaning that the natural gas input doubles the amount of electricity that is generated from the concentrated solar power field.

The e-Solar system, which has recently been bought by GE, enables small 5 MW modules to be purchased and uses simple production processes and non-specialised materials for the mirrors, so is cheaper than competing technologies such as parabolic troughs.

Large-scale photovoltaics with 6 hours of storage

ANE plans to augment the gas and CSP with utility-scale photovoltaics, along with NGK’s 6 hour Sodium Sulphur battery storage system – the world’s only bankable large-scale battery for wind and solar. The advantage of photovoltaics is that they are technically simple to install and capacity can be grown 1 MW per planned annual installation.

As the capital costs for the utility-scale solar roll-out are paid from retained earnings, foreign exchange risks and high required returns on capital are avoided for 85% of the solar roll-out.

Commercial overview

Revenue – ANE’s primary goal is to minimize the price it has to charge for electricity. It is estimated that the price charged will be slightly less than the forecast Eskom prices in 2015, and the lower feedstock costs (expected to be 75% less than international market value) mean that the levelised cost of electricity will be lower than any internal alternative – except for hydro-electric power. EBITDA are forecast to be high as much as 70% of revenues.

Debt funding – once the natural gas reserve has been proven, the project proposes a debt/equity ratio of 60:40, with debt protected by MIGA (Multilateral Investment Guarantee Agency) insurance at a cost of 1.75%. It is estimated that with the completion of an insured front-end-engineering and design (FEED) study, and the gas supply, local, owned and proven that debt can be raised at 200 basis points above the sovereign rate – about 10% in US$ and 14% in NA$ with 4% FX hedging cost. The loan will be repayable from cash generated from the first five years of production and the FX risk will be hedged – the Namibian dollar is linked to the rand, which has a deep enough FX market, while the MIGA insurance will cover currency repatriation, customer default and expropriation risks.

Equity returns – the project was designed to attract international equity investors, and as the natural gas will be supplied at marginal cost, makes it possible for the project to generate healthy returns, while selling the electricity at cheaper prices than alternatives at the state-owned utility faces. ANE targets returns of at least 30% with a five-year exit for international equity investors.

Local ownership – fostering indigenous ownership is a cherished policy of most African countries, which all use state procurement budgets to encourage local entrepreneurship. The ANE model enables 100% local ownership from year 6, with a local buy-out fund, which will be 100% leveraged secured by the revenues of the plant, by which time the foreign debt is repaid. 20% of free cash will be distributed as a dividend, while 80% will be reinvested in the carbon fund.

Project timelines

[1] Adapted for diagram – http://en.wikipedia.org/wiki/Natural-gas_processing

[2] Yukon Department of Energy, Mines and Resources,Oil & Gas Resources Branch, 2010, ENERGY FOR YUKON: THE NATURAL GAS OPTION – Eagle Plain Case Study – http://www.emr.gov.yk.ca/oilandgas/pdf/eagleplain_.pdf

0 Comments