Pre-feasibility study into solar energy rollout in Namibia

3. The Pricing of Electricity in Namibia

Modelling generation cost recovery – nature of commercial contracts

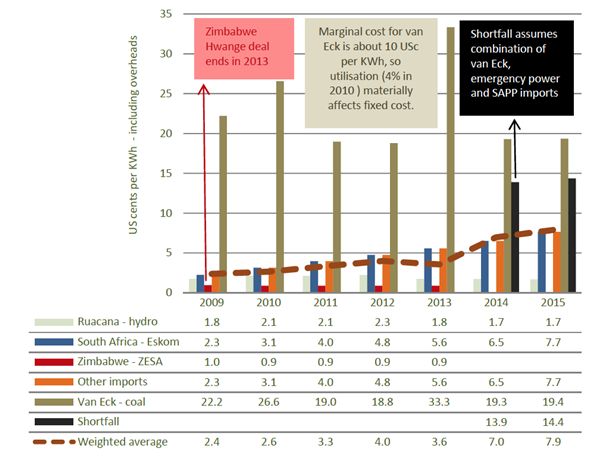

NamPower faces significant inflation – 25% per year in its purchases from Eskom and this will continue for the next two years. Establishing pricing information is not an exact exercise as much pricing data is not published, and in the pricing model certain assumptions have been made and dated information in some cases has been used. The model has been cross referenced with totals, Eskom pricing models and input from the local consultants ANE has engaged for the project. Generally, ANE estimates lower prices than NamPower has indicated to the consultants, and has exercised prudence in deriving its target price from its own model:

Figure 1 – NamPower cost of electricity from key sources, estimated

for years ended 30 June 2009 – 2015

As it is assumed that NamPower will be the only viable off-taker at a utility-scale, the unit price acceptable to NamPower is the most important input to the entire model.

The role of the Electricity Control Board in pricing

Namibian electricity prices are regulated by the Electricity Control Board and they indicated in several meetings with ANE that their first concern was to ensure that no proposal increased inflation for the end consumer, who already faces electricity increases of 25% per year in line with the Eskom increases that NamPower faces. The ECB has faced increasingly hostile audiences in explaining electricity price rises, as regional electricity distributors struggle to pay electricity prices. In Erongo, according to the Namibian newspaper, essential services are being trimmed due to the high levels of arrear payments on electricity bills – estimated in the article at 55%.

These tensions highlight the acutely political nature of any independent power purchase agreement in the current Namibian energy climate.

Wholesale electricity pricing distribution

Regional electricity distributor pricing

NamPower distributes power to regional electricity distributors (REDs), who in turn distribute electricity to end users. The REDs are facing cashflow pressures from arrears payments and are increasingly concerned about increased prices, as they are sandwiched between NamPower and customers who cannot afford to pay.

The electricity inflation numbers look like the regional electricity distributors will be the largest beneficiary of the electricity inflation, but they are not. Bad debts are becoming rampant, and the RED’s are depending on a smaller core of wealthier property owners to pay for electricity. Increasing numbers are being forced onto pre-paid electricity, which is more expensive than electricity on account.

Extending access to rural and peri-urban areas

Rural off-grid economics represent an impossible challenge for conventional grid transmission. Just 2.5 million people live in a country that has an area of 825,000 square kilometres. As about 50% live in urban or peri-urban areas, off-grid solutions that involve micro-generation renewables are the only practical way of solving this problem, but the cost is currently prohibitive and the beneficiaries cannot afford to pay. Some 40% of Namibians live on less than $1.25 per day.18 These people will need to be assisted on a carbon funded or grant basis as they are generally not involved in the cash economy.

Peri-urban dwellers represent a different challenge, they are also poor, but are generally involved to some extent with the formal economy. However, their informal dwellings are not permanent and will never be suitable for on-grid electrification. Only formal housing will get them onto the grid – and formal housing is outside the scope of this report.

0 Comments